GST Registration Near Me – Online GST Registration Process Step-By-Step Guide

Based on the “One Nation One Tax” policy, the government of India introduced GST in 2017. The application of Goods and Services Tax (GST) removed various undirected taxes such as VAT, Service Tax, CST, Excise Tax, etc., and simplified the taxation system.

This indirect tax applies to those businesses and professionals who fall under its categories. Currently, GST registration is mandatory for those businesses whose annual threshold limit exceeds 40 lakh, 20 lakh, and 10 lakh, depending on the case.

If your business needs GST compliance, you must register under GST. YourDoorstep is one of the best GST registration consultants in India, offering complete assistance across the city. We help with all aspects of GST registration, including providing details about required documents, completing the online process for a new GST number, responding to show-cause notices, and ensuring regular GST compliance.

Our team has successfully handled many complex GSTIN cases in India, so we guarantee timely registration for your business at the lowest cost. For any questions about GST registration or processing your application on the GST portal, feel free to call us at 9540005026 or visit our YourDoorstep office in India.

Types Of GST Applicable In India

India’s Goods and Services Tax (GST) system includes four types of GST, each aimed at simplifying taxation and ensuring fair revenue distribution.

You can comply with GST laws effectively if you understand these types when looking for GST registration near me:-

- SGST: State Goods & Services Tax (SGST) is applicable on those sales of goods and services that are conducted within a specific state. This part of the GST collected goes to that particular state.

- CGST: Central Goods & Services Tax (CGST) is also applicable to the sale of Goods and services conducted within a state. This part of the GST collected goes to the central government.

- UTGST: This refers to the Union Territory Goods and Services Tax. UTGST applies to those products that are sold within a particular union territory. This tax is received by the UT government.

- IGST: Integrated Goods and Services Tax (IIGST) applies to the inter-state movement of goods and services. The central government of India eventually collects this tax and distributes it to the respective states.

Read Also:- Apply For Gazette Notification for Name Change in Moga

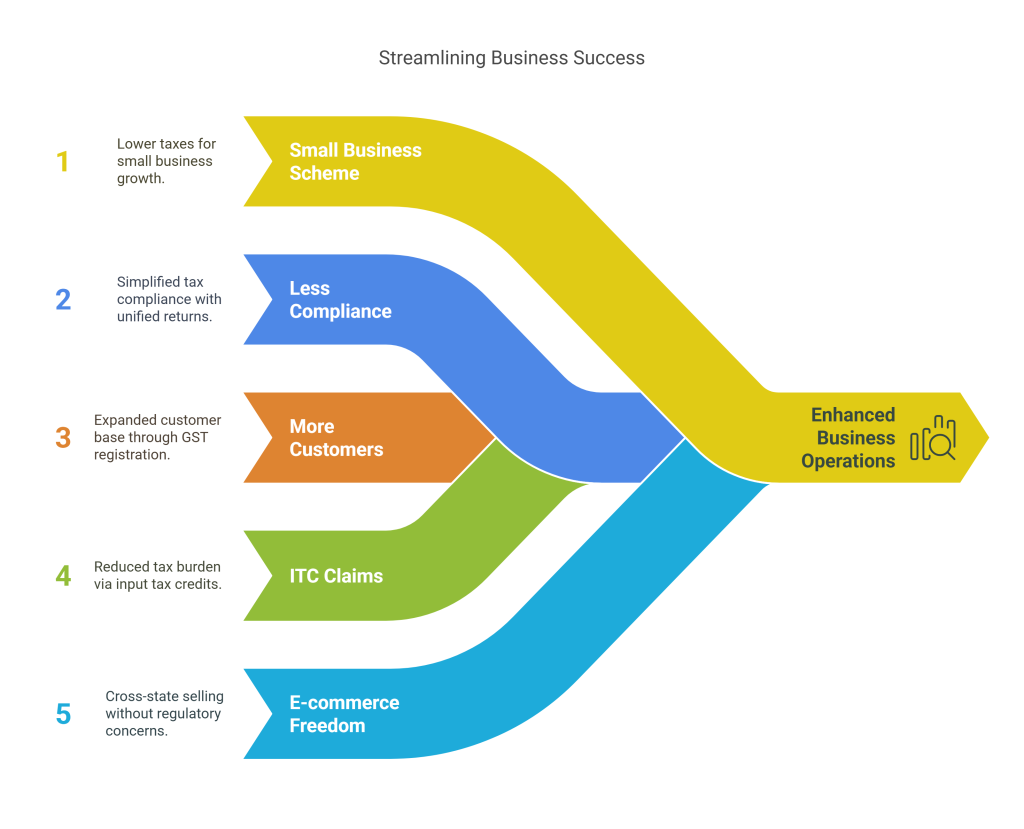

Benefits Of GST Registration

GST Registration in India has several benefits, some of which are listed below:-

- Small Business Composition Scheme: Under GST registration near me, small businesses enjoy the advantage of lower taxes. This scheme reduces the tax burden and allows more opportunities for growth.

- Less Compliance: Previous to GST, there were more compliances related to filing returns of various taxes. But now, you can file a single unified return.

- Access to More Customers: Online GST registration near me opens a gateway to a larger audience. As many organizations prefer to work with authorized dealers, this can increase the demand for your product.

- Benefit of ITC Claims: With GST registration near me, businesses can reduce the tax burden by claiming input tax credits paid for business purchases.

- E-commerce Treatment: GST-registered e-commerce sellers can freely sell products across states without worrying about state-specific regulations.

Who Can Apply For GST In India?

The following bodies can apply for GST registration near me in India:-

- Firms with exceeding turnover of Rs 40 Lakh, 20 Lakh, 10 Lakh, depending on the case.

- Any seller who offers goods and services through e-commerce platforms.

- Those who are paying taxes under the Reverse Charge Mechanism can apply for GST registration near me.

- Businesses registered with pre-GST laws such as Excuse, VAT, etc.

- Casual Taxable Person and Non-Resident Taxable Person.

Note: Small businesses near me enjoy exemption from GST registration if their annual turnover falls below the prescribed threshold limit. Therefore, they can manage their taxes easily.

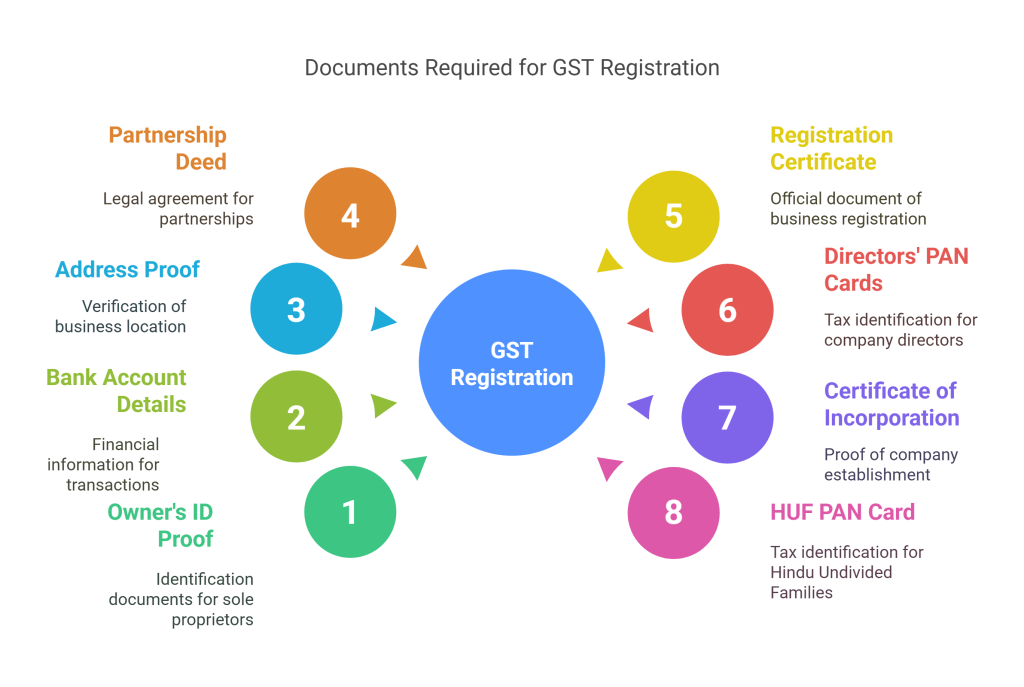

Documents Required For GST Registration Near Me

The GST registration documents under different forms of business organizations are as follows:-

For a Sole Proprietorship Business

- Owner’s ID proof PAN and Aadhaar Card

- Owner’s photo under prescribed format with good quality

- Bank account details of the proprietor

- Address proof of the proprietor

For General Partnership Firms and Limited Liability Partnership (LLP) Firms

- PAN card of the Partnership firm of LLP

- PAN Card of all the partners, including authorized signatory

- Photo of all the partners in the prescribed format

- A copy of the partnership deed

- Registration certificate

- Authorized signatory’s mobile number, Aadhaar, and email

- Bank account details

- Conclusive evidence of the location of your business.

For Private/Public/One Person Company

- PAN Card of the company

- Directors’ PAN Card

- Certificate of Incorporate

- Photo of all the directors and authorized signatures

- Authorized signatory’s mobile number, email, and Aadhaar

- Bank account details of the company

- Proof of location of the head office of the company

- Article of Association / Memorandum of Association

For Hindu Undivided Family HUFs

- PAN card of HUF

- PAN card of Karta

- Aadhar And photo of Karta

- Bank account details

- Address proof of business.

Online GST Registration Process With Your Doorstep

Your Doorstep offers easy solutions for clients. Just follow these simple steps for local GST registration services and let the experts take care of the rest.

Step 1: Consult With Us

Start by consulting with our experts to understand the procedure followed for GST registration near me.

Step 2: Provide Business Details & Documents

Provide our experts with all the necessary business details and documents for GST registration near me based on the type of your business. These details may include a PAN card, bank details, identity proof, registration certificate, etc.

Step 3: GST Registration

Upon receiving the required information, our experts will handle the GST registration near me process. The process will involve an OTP verification on your registered mobile number.

Step 4: Get Your GSTIN Certificate

After the verification is done, you will be issued your GST certificate with GSTIN.

Our service fee includes the nominal charges and new GST registration fees, depending on the case.

GST Return Filing

When the GST registration near me is done, it is mandatory that you file the return, even if you have 0 turnover. There are 4 types of GST returns that you have to file every month.

The details regarding these returns are summarized here:-

- GSTR 3B Monthly: Everyone commonly fills out this return each month. GSTR 3B contains the return summary, which is compulsory to be filed by the 20th of the following month. Return filing is compulsory even if no sale is made during that period.

- GSTR 1 and 2: This return is filed either monthly or quarterly. GSTR 1 contains the details of invoices raised in the previous month, while GSTR 2 involves information on the inputs consumed during that period.

- GSTR 3 Final: GSTR 3 contains the summary of all the transactions filed with the authorities. It also includes transactions mentioned in GSTR 1 & 2 during the previous quarter or month.

Voluntary Registration Under GST

Valuntary Registration under GST is when the owner wants to get the business registered under GST. The act is not legally mandatory, but some people do so to experience certain advantages. Any business who have less than 20 lakhs of annual turnover can voluntarily apply for GSTIN through local GST registration services.

Voluntary GST registration comes with certain advantages, which can be understood as follows:-

- Small and micro enterprises can increase their business operations with voluntary GST registration. It allows them to find more clients and get access to online platforms.

- With voluntary GST registration, businesses can get the advantage of Input Tax Credit. This increases the margin of profits, leading to more growth and expansion.

- Small vendors and businesses can take their products to a large audience through e-commerce websites.

Penalty For Not Getting GST In India

In India, if any business organization falling under the category of GST norms is not paying tax or making dues, it is liable to pay the penalty. For these situations, a penalty of a minimum of 10,000 rupees or 10% of the due tax amount is imposed. This penalty becomes 100% of the tax due if the business fails to clear the due amount even after warnings.

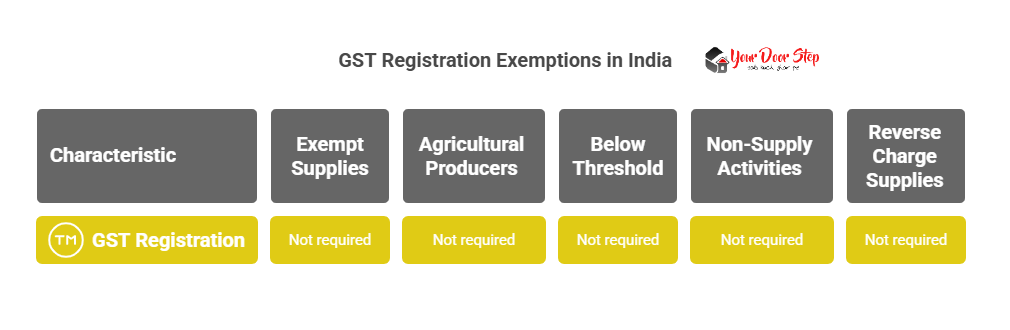

Exemption On GST Registration In India

According to the laws, the following persons are exempted from GST Registration requirements.

- People engaged in exempt supplies, such as items not covered under GST norms, are not required to get free GST Registration near me.

- Agricultural produce is exempt from GST. Hence, farmers are not required to get GST registration.

- People below the prescribed threshold limit are not required to get GST registered.

- People engaged in activities not considered as a supply of goods or services are not required to get GST registration.

- People who are engaged in making supplies under a reverse charge mechanism are excluded from GST registration online.

Why Choose Your Doorstep For GST Registration In India?

Choosing yourdoorstep for your local GST registration services can offer you hassle-free results. Our experts are experienced professionals who understand the specific needs of any business.

Here is why you should prefer us:-

- Expert Guidance: Here, you get expert guidance from experts such as CA, CS, and Lawyers who are familiar with GST laws and regulations.

- Quick & Easy Process: Engaging with us offers you quick and smooth working. We assist you in every arrangement.

- Complete Online: The work procedure is purely online, allowing you the convenience of interacting with us from anywhere.

- Personalized Solutions: We offer personalized solutions depending on the special needs of your business.

- 24/7 Support: 24/7 expert support is available to the users through live chat and GST registration near me contact number to address your problems and queries.

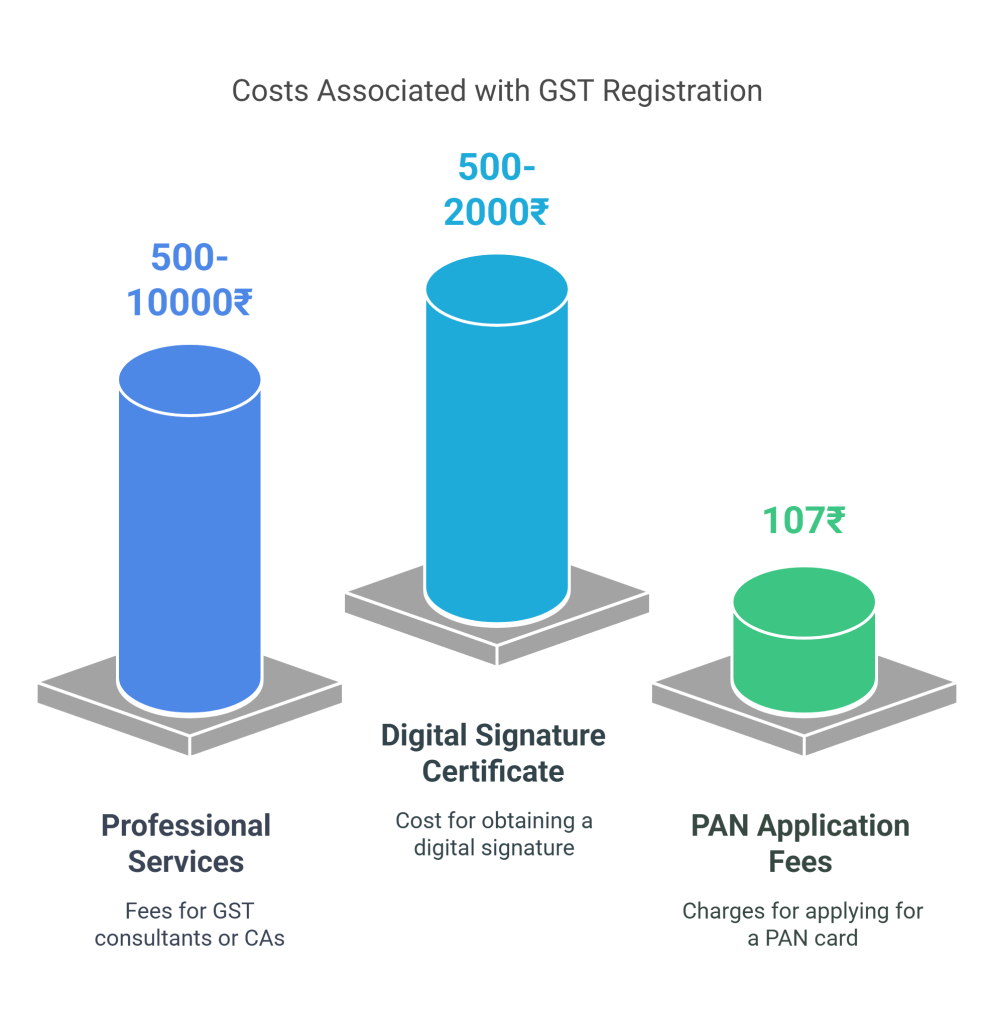

Online GST Registration Fees

GST registration is free if done through the official GST portal. However, hiring professionals like GST consultants or CAs may cost ₹500–₹10,000, depending on your business type (sole proprietorship, partnership, company, etc.). Additional costs may include a Digital Signature Certificate (₹500–₹2,000) or PAN application fees (₹107). Professional services ensure smooth registration and compliance with GST rules.

Conclusion

After going through the above details, you must understand how your doorstep offers GST registration services. With years of experience, we understand the special needs of any business. When people approach us for GST registration near me, we try to offer a hassle-free experience at an affordable cost. If your business needs GST registration, feel free to contact us anytime.

Also Read:-

UAE Attestation in Noida: Easy Step-by-Step Guide

How to Change Name in Gujarat: A Guide To Gazette Name Change Procedure in Gujarat

How To Change Name in Andhra Pradesh: Guide To Gazette Name Change Procedure in Andhra Pradesh

Gazette Name Change Procedure in Madhya Pradesh: Your Complete Guide

Frequently Asked Questions (FAQs)

Is GST Registration Mandatory For Small Businesses?

No, small businesses below the turnover threshold are not required to register for GST unless they engage in specific activities like inter-state sales or e-commerce. However, they can opt for voluntary registration.

How Long Does It Take To Get GST Registration?

The process typically takes 7–10 working days after submission of all required documents and verification.

Can I Register Voluntarily Even If My Turnover Is Below The Threshold?

Yes, businesses can voluntarily register for GST to avail of benefits like input tax credits and legal recognition as a supplier of goods or services.

What Is The Validity Of A GST Registration Certificate?

For regular taxpayers, the GST registration certificate does not expire unless canceled. However, casual taxable persons and non-resident taxable persons have temporary registrations valid for up to 90 days, which can be extended once.

Do I Need Separate GST Registrations For Multiple States?

Yes, if your business operates in more than one state, you must obtain separate GST registrations for each state where you conduct business.

Can I Apply For GST Registration Offline?

No, GST registration is an entirely online process. You must apply through the official GST portal (www.gst.gov.in) and upload all required documents electronically.

Written by

Surbhi Sharma

Content Author at YourDoorStep

Contributor at YourDoorStep.